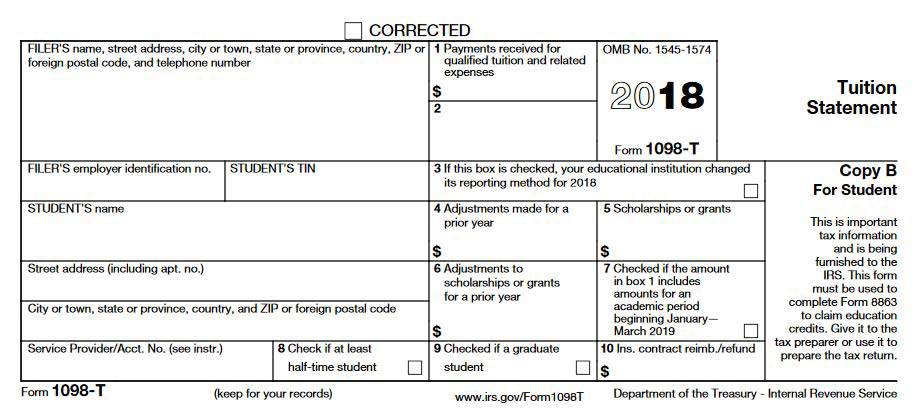

1098-T Information

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

Gaston College is unable to provide you with individual tax advice. Should you have questions, you should seek the counsel of an informed tax preparer or adviser.

Below is a blank sample of the 2018 Form 1098-T for your general reference. For more information about Form 1098-T, visit https://www.irs.gov/pub/irs-pdf/f1098t.pdf.

You may contact the Business Office at 704-922-6414 if you have questions.